Rare Element Resources

Bear Lodge Project

Canadian NI 43-101 Technical Report

October 9

th

, 2014

10035-200-46 - Rev. 0

22-9

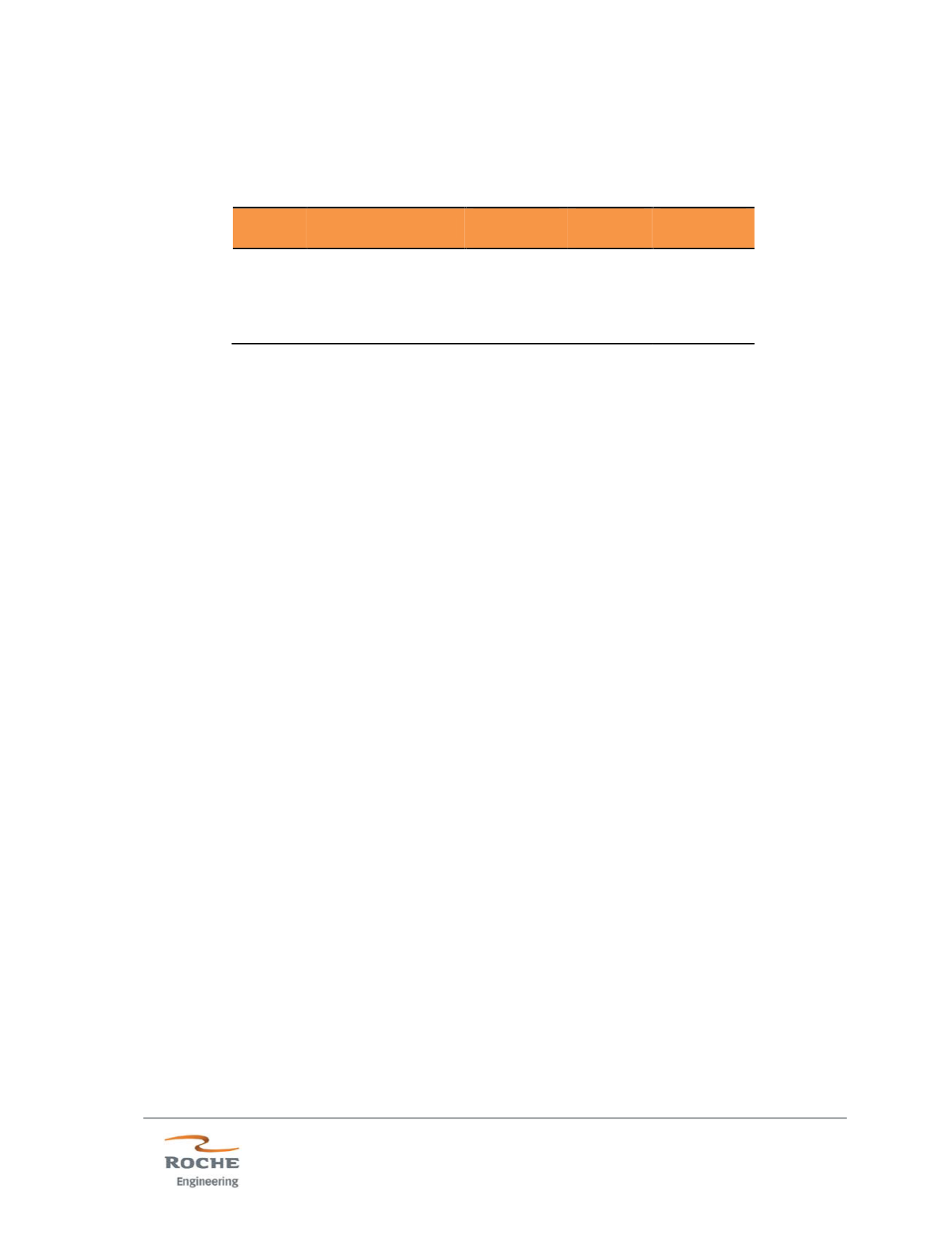

Property tax on land for the project is calculated as shown in Table 22.10.

Table 22.10 - Property Tax on Land Cost Summary

Site

Acreage Value

Land

Value

Mill

Rate

Annual

Tax

Mine

1000

$3,000

$3 million

76

$20,520

Upton

1000

$3,000

$3 million

76

$20,520

Total:

$41,040

(Roche, 2014)

22.4.1 Taxes Calculation Assumptions

•

The property tax on land calculation is assumed constant for the life of the

project;

•

Property tax on the plants is calculated as the book value of the capitalized

assets multiplied by 11.5%, then assessed at the 76 mil rate;

•

Severance and Ad Valorem taxes are computed by first calculating the

percentage of total revenue considered taxable revenue. This is

accomplished by identifying the percentage of mining costs (costs incurred

prior to “mouth of mine”) as a percentage of total mining and processing

product costs. This percentage is multiplied by total revenue to establish total

taxable revenue (“state taxable revenue”). The resulting state taxable

revenue is then multiplied by the severance and ad valorem rates to compute

the respective taxes;

•

Wyoming does not have a state income tax;

•

Federal taxes are estimated based on estimated taxable income calculations

within the model, taking into consideration the Company’s historical net

operating loss carry-forwards as well as alternative minimum tax regulations.

The estimates utilize a percentage depletion rate of 14%.

22.4.2 Tax Impacts

•

The tax burden associated with property, severance and ad valorem taxes

peaks in the first two years of production. As the capitalized assets depreciate

and their corresponding book values decline, the liability for property tax on

capitalized property decreases;

•

The federal tax burden varies throughout the mine life based on factors driving

revenues and expenses such as ore recovery and associated

hydrometallurgical operating costs, sustaining capital expenditures and

depreciation, among other factors.