Rare Element Resources

Bear Lodge Project

Canadian NI 43-101 Technical Report

October 9

th

, 2014

10135-200-46 – Rev. 0

22-2

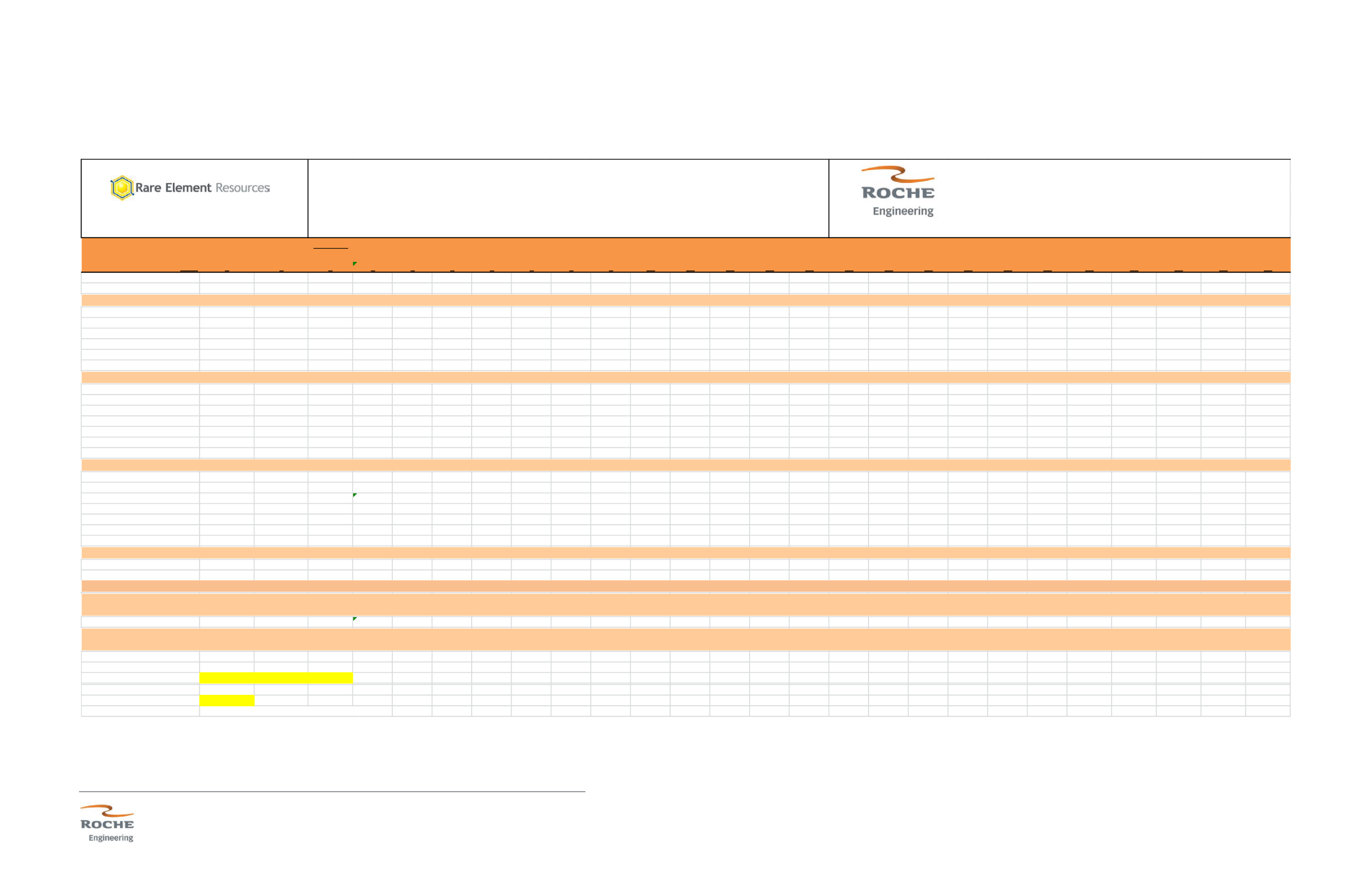

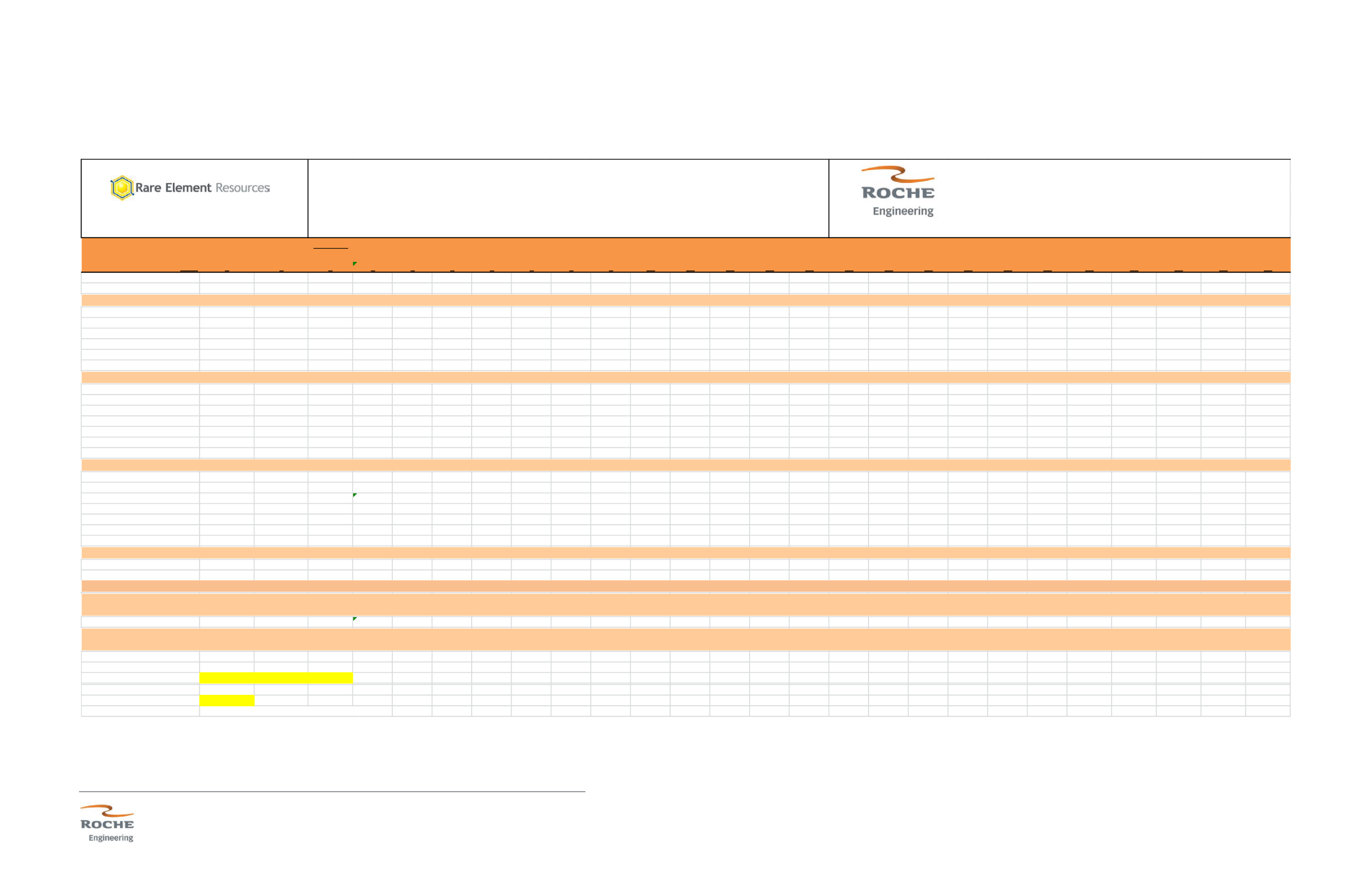

Table 22.2 - Cash Flow Forecast

Rare Elements Earth Resources

All numbers 000 YrofProd 1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

Bear Lodge REEProject - Financial Analysis

Year

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Mine Plan, Tons

PUG Feed Rate, STPY

220

219

219

226

212

220

217

220

226

392

424

536

549

444

328

322

293

285

286

292

302

325

459

PUG Feed Rate, STPY

220

219

219

226

212

220

217

220

226

392

424

536

549

444

328

322

293

285

286

292

302

325

459

Capital Costs

PUG

0

2,924

9,087

0

0

0

0

0

0

0 17,064 38,907

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Hydromet

0

62,825 93,687 9,862

0

0

0

0

0

0

0 1,852

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Capital Replacement

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Sub Consultant Costs

840

1,504 102,888 7,427

0 4,538

368

0 2,688 3,969

700 7,476 1,402

0

0

491

0 16,263 1,814

0

174

0

5,863

7,876

0

0

Working Capital

24,603

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Annual Cap cost

840

67,254 205,662 41,892

0 4,538

368

0 2,688 3,969 17,764 48,235 1,402

0

0

491

0 16,263 1,814

0

174

0

5,863

7,876

0

0

Operating Costs

PUG

4,470 4,452 4,453 4,601 4,390 4,488 4,452 4,489 4,547 8,410 9,062 11,064 11,420 9,508 7,118 7,052 6,390 6,262

6,311

6,457

6,694

7,216

9,444

Hydromet

68,126 65,868 64,790 65,468 68,633 60,177 60,643 59,211 57,773 71,289 72,629 80,503 84,155 79,637 74,134 73,786 78,423 79,316 79,845 71,451 71,453 69,910 82,469

Mining Operations

15,133 15,034 15,034 14,786 14,782 15,881 15,880 15,886 15,768 15,805 15,782 15,818 15,822 15,789 17,774 17,772 17,763 17,761 17,761 17,763 19,645 19,652 19,695

Upton TSF Operations

804

802

802

801

801

801

801

801

801

801

801

801

801

801

801

801

801

801

801

801

801

801

801

G&A Operating Costs

0 6,603 6,603 6,603 6,603 6,603 6,603 6,603 6,603 6,603 6,603 6,603 6,603 6,603 6,603 6,603 6,603 6,603 6,603

6,603

6,603

6,603

6,603

6,603

Miller Creek Road Maint.

0

230

230

230

230

230

230

230

230

230

230

230

230

230

230

230

230

230

230

230

230

230

230

230

Annual Op Cost

0

0

0 95,368 92,989 91,912 92,490 95,440 88,181 88,610 87,221 85,722 103,139 105,108 115,018 119,032 112,568 106,660 106,244 110,211 110,973 111,552 103,305 105,427 104,413 119,242

Annual Revenue

Market Price per Kg

$24.60

$24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60 $24.60

Market Price per st

$22,317

$22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317 $22,317

Ore Grade,(% REO)

5.96

5.45

5.25

4.96

5.29

4.07

3.89

3.66

3.53

3.12

3.00

2.82

2.54

2.58

3.06

2.95

3.46

3.44

3.30

3.15

3.00

2.73

2.02

Overall Recovery,%

81.6% 81.9% 81.6% 81.9% 83.0% 82.2% 81.9% 81.8% 81.2% 77.7% 76.5% 70.3% 69.4% 74.3% 80.1% 80.2% 81.7% 82.8% 83.2% 81.2% 80.3% 78.8% 76.0%

Rare Earth Mineral, tons

10,696 9,777 9,379 9,183 9,310 7,535 7,056 6,877 6,890 9,496 9,718 10,621 9,662 8,521 8,033 7,627 8,279 8,128

7,859

7,468

7,275

6,983

7,058

Rare Earth Mineral, $

0

0

0 238,698 218,181 209,308 204,930 207,776 168,163 157,459 153,476 153,768 211,931 216,881 237,027 215,624 190,167 179,278 170,206 184,763 181,402 175,388 166,663 162,350 155,846 157,513

Annual Tot Rev

238,698 218,181 209,308 204,930 207,776 168,163 157,459 153,476 153,768 211,931 216,881 237,027 215,624 190,167 179,278 170,206 184,763 181,402 175,388 166,663 162,350 155,846 157,513

State Tax

41

41

70 4,399 5,464 5,702 5,311 4,954 4,506 4,040 3,751 3,481 3,503 3,282 3,052 2,629 2,453 2,729 2,756 2,850 2,754

2,631

2,684

2,850

2,826

2,480

Federal Tax

0

0

0 2,033 18,900 15,161 14,309 14,619 8,662 6,747 5,903 6,719 17,793 19,787 21,909 16,971 13,288 12,098 10,231 12,375 11,968 11,586 11,525 10,085

8,921

6,360

Taxes

41

41

70 6,432 24,364 20,863 19,620 19,573 13,168 10,787 9,654 10,200 21,296 23,069 24,961 19,600 15,741 14,827 12,987 15,225 14,722 14,217 14,209 12,935 11,747

8,840

Pre Tax Cash Flow

-881

-67,295 -205,732 97,039 119,728 107,156 106,762 107,383 72,789 60,840 44,740 16,330 103,887 108,492 118,957 93,472 75,147 53,625 59,392 71,702 67,501 61,205 54,810 46,197 48,607 35,791

After Tax Cash Flow

-881

-67,295 -205,732 95,006 100,828 91,995 92,453 92,764 64,127 54,093 38,837 9,611 86,094 88,705 97,048 76,501 61,859 41,527 49,161 59,327 55,533 49,619 43,285 36,112 39,686 29,431

Cumulative After Tax Cash Flow

-881

-68,176 -273,908 -178,902 -78,074 13,921 106,374 199,138 263,265 317,358 356,195 365,806 451,899 540,604 637,652 714,153 776,012 817,539 866,701 926,027 981,560 1,031,179 1,074,465 1,110,576 1,150,263 1,179,694

Annual Pre Tax Disc. Cash

-881

-61,177 -170,027 72,907 81,776 66,536 60,264 55,104 33,957 25,802 17,249 5,723 33,102 31,426 31,325 22,377 16,354 10,609 10,682 11,724 10,034

8,271

6,733

5,159

4,935

3,303

Annual Post Tax Disc. Cash

-881

-61,177 -170,027 71,380 68,867 57,122 52,187 47,602 29,916 22,941 14,973 3,368 27,432 25,695 25,556 18,314 13,462 8,216 8,842 9,700 8,255

6,705

5,317

4,033

4,029

2,716

Discount Rate

8.00% 10.00% 12.00%

Pre Tax NPV

563,657

426,663 327,586

After Tax NPV

443,983

331,485 249,958

Pre Tax IRR

32.78%

After Tax IRR

28.70%

Note: Post tax refers to post Federal Taxes

FINANCIAL MODEL

10135-001

RARE ELEMENT RESOURCES INC.

PREFEASIBILITY STUDY UPDATE

September 18, 2014

Revision: O