Rare Earth Elements

What are Rare Earths?

Known as “the seeds of technology,” rare earth elements (REEs) make today’s emerging technologies possible – from the miniaturization of electronics, to the enabling of “green” and medical technologies, to supporting essential defense, telecommunication, and transportation systems. REEs have unique magnetic, phosphorescent, and catalytic properties. In permanent magnets, they radically boost the magnetic strength, benefiting a wide array of uses.

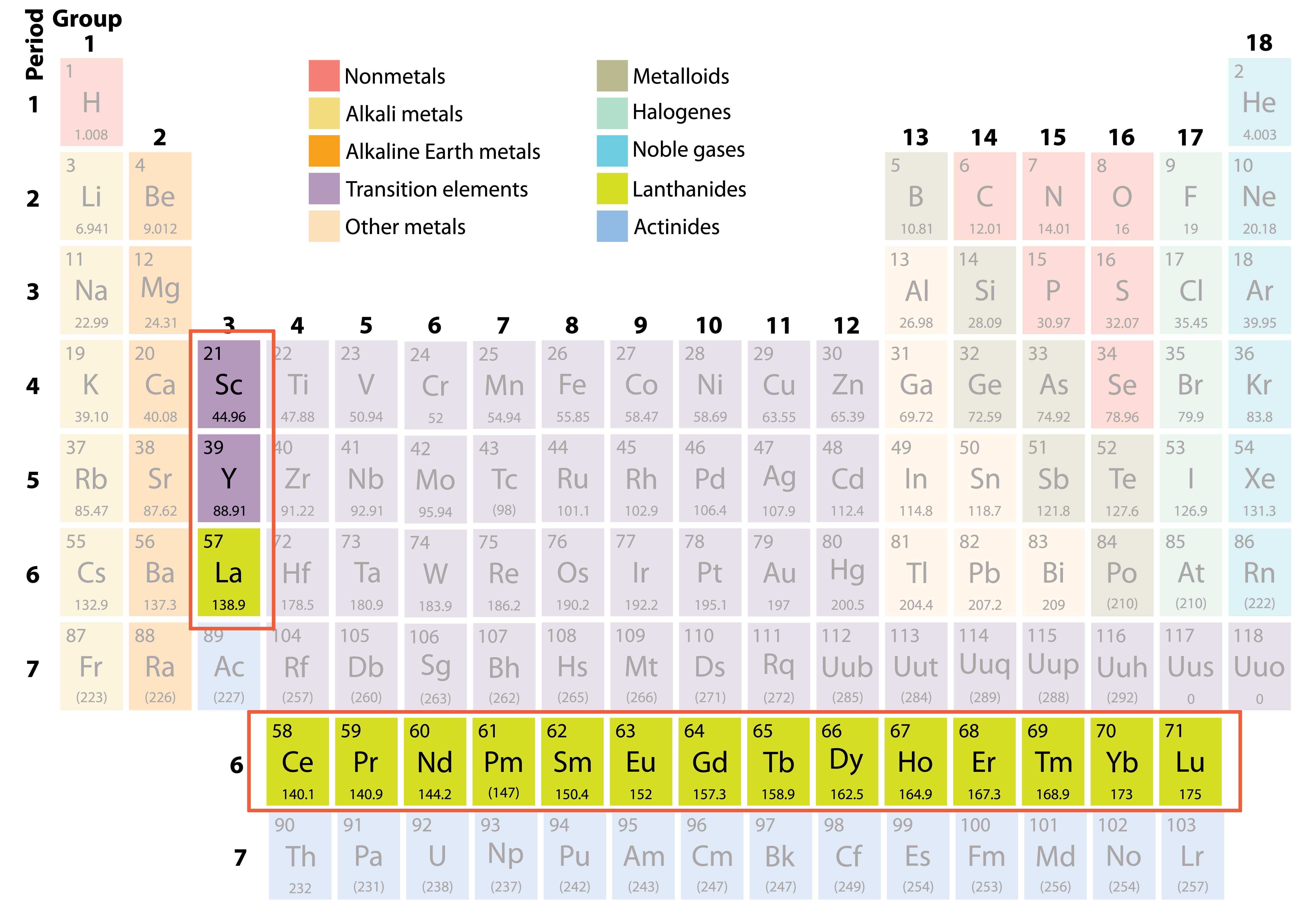

Which Elements are They?

REEs are a set of seventeen chemical elements in the periodic table, specifically the fifteen lanthanides plus scandium and yttrium. Scandium and yttrium are considered REEs since they tend to occur in the same mineral deposits as the lanthanides and exhibit similar chemical properties, which includes being malleable with high melting and boiling points. Each of the REEs contain a subshell that houses f-electrons, which give them their magnetic and luminescent properties, and all are considered metals.

Why are they so important?

REEs unique characteristics allow them to enhance the performance of other metals and in most cases result in a reduction of the amount of metal necessary for an application, allowing things to be smaller and lighter. They are used in everyday technologies like a cellphone and computer. They are also used in advance medical technologies like MRIs, laser scalpels and even some cancer drugs. In defense applications, they are used in satellite communications, guidance systems and aircraft structures. They are critical in a number of green technologies, especially those that are going to support net zero carbon emissions goals, like wind turbines and electric vehicles.

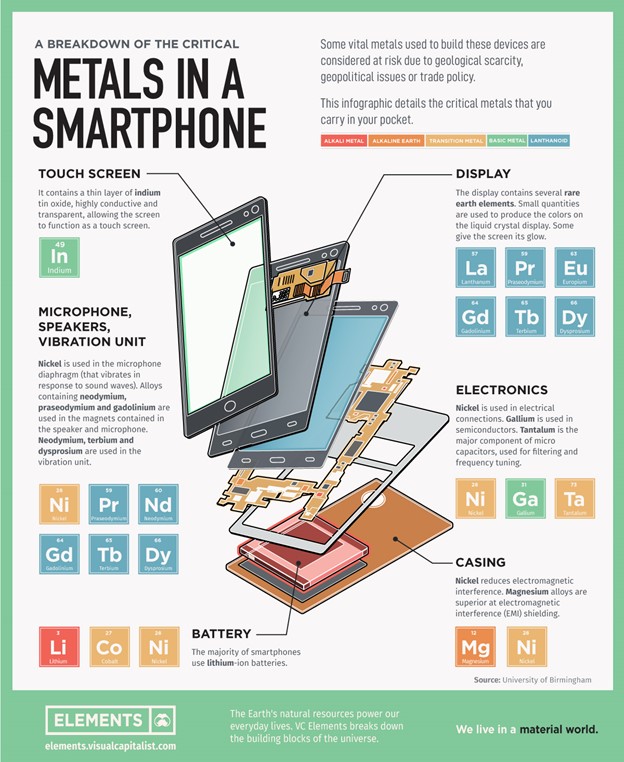

With rare earths, a little goes a long way. The amount of rare earths used in high tech equipment is small but almost always critical to the unit’s performance. For example, a smartphone uses seven rare earths – for everything from its colored screen, to its speakers, to the miniaturization of the phone’s circuitry. While the amount of rare earths in each phone is very small, the quantity of phones sold each year is astounding. Apple iPhone sales went from around 55.8 million units in 2010 to about 225 million in 20221

Where do They Come From?

While named “rare” earth elements, they are in fact not that rare and are relatively abundant in the Earth's crust. What is unusual is to find them in quantities sufficient to support economic mineral development, especially in countries with more stringent mining laws and environmental programs.

Initially, REEs were recovered as a step in the process of mining and recovering uranium. In the 60s, the adoption of color television resulted in the first significant commercial use for REEs, the majority of which were mined in California. Because traditional recovery processes are highly labor intensive and generated significant pollution, China became the world's dominant producer of REEs in the 1990s. With its lower wages and more lax environmental laws, no other nations could compete. By 2000, China was responsible for more than 95% of world’s REE mining.

With the market cornered on REE mining, China proceeded to build a robust mines-to-magnet industry, which saw high-tech countries like Japan and the US dependent on them for their emerging technologies. The dangers of this monopoly became highly evident after a 2010 territorial conflict resulted in China embargoing the sale of REEs to Japan. Several U.S. administrations have identified the monopoly by China of the REE supply chain as an issue of national concern. A 2021 report by the Foreign Policy Research Institute identified it as “one of the largest strategic vulnerabilities to the United States and her allies since the Arab oil embargo-triggered energy security crisis of the 1970s.”2

Over the last several years, mining of REEs has diversified. Approximately 35% of the REE minerals in 2022 were being mined outside of China. Unfortunately, this diversification has not expanded to the rest of the supply chain and, as the graph below demonstrates. Even today, a majority of the REEs mined in other countries are still being send to China for separation, refining and magnet production, allowing China to continue to dominate the REE supply chain.

Current REE Supply Chain Capacity, 20223

What is Being Done to Address the US’s Vulnerability when it Comes to REEs?

Both the Biden and Trump administrations have completed studies that indicate the U.S. is at risk – economically, security wise and with its goals for carbon reduction – because it does not have a secure source of a number of critical minerals, including REEs. The Foreign Policy Research Institute stated, “Decreasing reliance on China for the supply of these vital resources will enhance strategic stability and ensure enduring self-reliance in the face of increasing adversarial relations with Beijing.”2

In support of building robust and secure supply chains for REEs and other identified strategic minerals, Congress has approved over $800M to fund research. For REEs, this includes areas such as sourcing, either through mining or recycling, developing innovative separation and recovery technologies, and increasing efficiency in existing applications to lower demand growth.

Under these initiatives, Rare Element Resources has received a commitment from the Department of Energy for a total of approximately $22 million, representing 50% of the total anticipated cost for development of a demonstration-scale plant to confirm the commercial viability of the Company’s innovative separation and recovery technology. This plant, which is expected to receive final permits in the summer of 2023 and begin construction later in 2023, is the next step in helping develop a secure, long-term source for the REEs critical to our high-tech world.

1Statista.com, Apple iPhone Revenue since 3rd Quarter 2007

2U.S. Department of Energy, Rare Earth Permanent Magnets: Supply Chain Deep Dive Assessment, February 2022

3Foreign Policy Research Institute, America’s Critical Strategic Vulnerability: Rare Earth Elements, June 2022