Rare Element Resources Ltd. (NYSE Amex: REE and TSX: RES) is pleased to announce the results of a positive Pre-Feasibility Study (PFS) for the Bear Lodge project, Wyoming.

Rare Element Resources Ltd. (NYSE Amex: REE and TSX: RES) is pleased to announce the results of a positive Pre-Feasibility Study (PFS) for the Bear Lodge project, Wyoming. The PFS was commissioned to provide a technical document for the resource model, present the technical activities for the rare-earth exploration program, provide a detailed process description and present an economic analysis of the rare-earth resources. The results of the PFS show that the Bear Lodge project is technologically feasible with robust returns on invested capital.

Mr. Randall Scott, President and CEO, stated, "We are very encouraged with these results. The PFS was designed to provide an engineering and economic assessment of the viability of the Bear Lodge project and, more specifically, the Bull Hill Rare-Earth Element (REE) open pit mine, and these results clearly demonstrate the solid economics of this project. We feel that conservative economic data were utilized in this report so to receive such positive results clearly shows the merit of the Bear Lodge project and we will continue on with the development of a bankable feasibility study. Additionally, we will be finalizing a National Instrument (NI) 43-101 technical report in the near term and that report will be filed with regulatory agencies. The NI 43-101 technical report will include the updated mineral reserve and resource estimates that will encompass those drill results from the 2011 exploration season for which we already have received assay results."

Highlights

The Bear Lodge PFS addressed all aspects for the development of the project including infrastructure, open-pit mining, mineral concentration, and hydrometallurgical processing. Roche Engineers, Inc. was the independent consulting group who carried out the PFS on behalf of the Company. Other consulting groups who provided information and expertise included Ore Reserves Engineering (O.R.E.), John T. Boyd Company, Mountain States R & D International, Hazen Research Laboratories, and IMCOA, an independent industrial minerals research firm based in Perth, Australia.

Financial Analysis

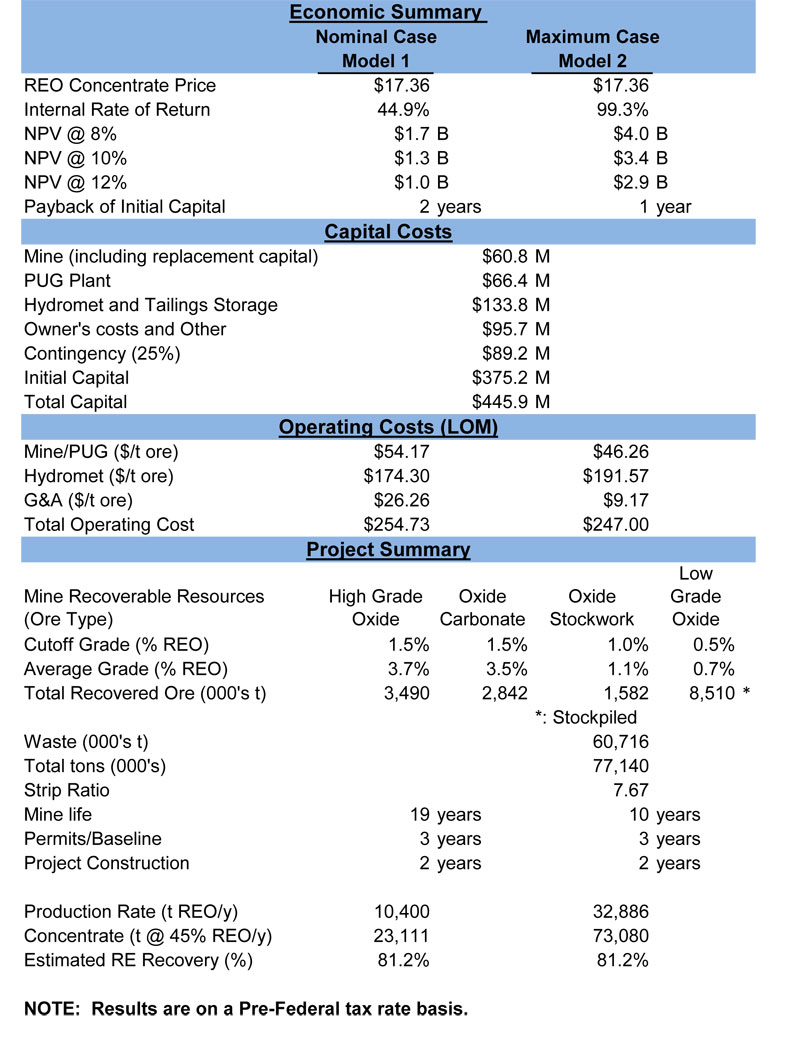

The economic analysis that was performed for the PFS on the Bear Lodge project was conducted with both a Nominal (Model 1) and a Maximum (Model 2) production schedules. The Nominal production schedule was considered as the base case. The major factor differentiating the Nominal case with the Maximum case is the mine life and production schedule. The Nominal case addresses production of 23,111 tpa (tons per annum) of concentrate production at 45% REO (rare-earth oxide) for a mine life of 19 years while the Maximum case provides for production of 73,080 tpa of concentrate at 45% REO for a mine life of 10 years.

Total life-of-mine capital costs for the project have been estimated at $445.9 million including a 25% contingency of $89.2 million. The initial capital cost is $375.1 million. This includes $127.2 million for the PUG (Physical Up-Grade) plant and mine (including replacement capital) and $133.8 million for the Hydromet plant. Initial capital expenditures are assumed to span the first four years, with infrastructure heavily weighted in the first two years and plant construction heavily weighted in the second two years. There has been a trend toward increasingly higher equipment prices and input costs that have resulted in higher capital expenditures throughout the mining industry over the past years.

The Nominal base case and the Maximum case both assumed an average price of $17.36 per kilogram (kg) of bulk mixed RE concentrates with an average grade of 45% TREO (total rare-earth oxide). This price is a three-year trailing average of prices from the Metal-Pages bulletin. Recognizing that the output concentrate produced from the Bull Hill mine is a "basket mix" of individual rare earth oxides, a discount of 40% was assumed for the pricing in the economic models.

The economic analysis also calculated that the break-even cash flow price for RE concentrate is $4.42/kg, which is 75% below the $17.36 price used in the models. The price required to achieve an IRR of 30% is approximately $11.70, which is 33% lower than the price assumed for both cases.

Mine Design and Mining Operations

The mine will be operated as a conventional truck-shovel open pit mine. The PFS determined that the scope of the development of the Bear Lodge project should consist of two components: the open-pit mine operations and PUG (physical upgrade) plant on-site at the Bull Hill mine and the Hydromet plant (hydrometallurgical) at Upton, Wyoming, adjacent to the railway line. Upton is located approximately 40 miles from Bull Hill mine. The PUG plant is designed to maximize the rare earth ore and produce a pre-concentrate using a gravity separation and screening and wash process. This pre-concentrate will be transported to the Hydromet plant at Upton, Wyoming where a rare earth concentrate will be produced.

The PUG plant is designed to process up to 1,000 tpd (tons per day) of high-grade oxide material and 1,000 tpd of oxide carbonate and stockwork material which will be blended to meet mine pit production plans and market demands. The PUG process employs a series of crushing, attritioning, washing and screening methods to concentrate the RE fines and reduce the physical mass. Harder stockwork ores are used as the attritioning media to break up the clay-like oxide ores. There are areas of the Bull Hill Mine that contain variable amounts of weathered oxide ores and other areas that contain intermittent stockwork. Each of these ore types has a different upgrade percentage and mass reduction in the PUG circuit. These product streams from the different ore types will combine to produce a pre-concentrate with the overall processing strategy to maximize the RE grade and recovery, and minimize the mass or tonnage of the pre-concentrate that is transported to the Hydromet plant.

The Hydromet plant has been designed with two parallel circuits to process the pre-concentrate from the PUG plant. The nominal REO (rare earth oxide) production rate is anticipated to be 10,400 tons per year. The Hydromet process will use a hydrochloric acid solution, heated to 90°C (degrees Celsius) to leach the REE from the concentrate. Iron is then precipitated from the solution, and calcium and manganese are extracted by an ion exchange process. The REE are finally precipitated as carbonates through the use of sodium carbonate.

Both the Nominal base case and the Maximum case utilized only the Bull Hill deposit. Rare Element has been exploring additional deposits that, thus far, have not been determined to contain mineral reserves nor resources. As we continue to advance the Bear Lodge project, exploration will continue at the outlying deposits where drilling has indicated that HREE's (heavy rare-earth elements) appear to be more prevalent. If these deposits are found to contain economically feasible mineral reserves and resources, then there would be the opportunity to either prolong the life of the mine or increase annual production of REO concentrate.

The life of mine operating costs for the Nominal Base case have been estimated at $54.17/t ore for the mining and PUG costs, $174.30/t ore for the Hydromet plant, $26.26/t ore for G&A costs for a total operating cost of $254.73. The Maximum case life of mine operating costs are $46.26/t for the mining and PUG operating costs, $191.57/t for the Hydromet plant costs, $9.17/t for G&A for total costs of $247.00/t.

Markets for Rare Earths

Rare Element has been and continues to negotiate with some highly recognized companies for potential off-take partnerships.

Rare-earth elements are key components of the green energy technologies and other high-technology applications. Some of the major applications include hybrid automobiles, plug-in electric automobiles, advanced wind turbines, computer hard drives, compact fluorescent light bulbs, metal alloys in steel, additives in ceramics and glass, petroleum cracking catalysts, and many others. China currently produces more than 96% of the 124,000 tonnes of rare-earths consumed worldwide annually, and China has been reducing its exports of rare earths each year. The rare-earth market is projected to grow rapidly as these green technologies are implemented on a broad scale. Rare earths are critical and enabling metals for the green technologies.

Jaye T. Pickarts, P.E., serves as the Chief Operating Officer of the Company as an internal, technically Qualified Person. Technical information in this news release has been reviewed by Mr. Pickarts, and has been prepared in accordance with Canadian regulatory requirements that are set out in National Instrument 43-101. This news release was prepared by Company management, which takes full responsibility for content. Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Rare Element Resources Ltd. (NYSE Amex: REE and TSX: RES) is a publicly traded mineral resource company focused on exploration and development of rare-earth elements and gold. In addition to the REE exploration and evaluation efforts, the Company is exploring for gold on the Sundance project, which is located on the same property in Wyoming.

ON BEHALF OF MANAGEMENT

Jaye T. Pickarts, P.E., Chief Operating Officer

For information, refer to the Company's website at www.rareelementresources.com

or contact:

Anne Hite, Director of Investor Relations, 720-278-2466 or ahite@rareelementresources.com.

Forward Looking Statements

Except for statements of historical fact, certain information contained herein constitutes forward-looking statements. Forward looking statements are usually identified by our use of certain terminology, including "will", "believes", "may", "expects", "should", "seeks", "anticipates", "has potential to", or "intends' or by discussions of strategy or intentions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results or achievements to be materially different from any future results or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts, and include but are not limited to, statements with respect to future economic conditions and project operating results, anticipated capital and operating costs, commodity prices, estimates of mineral reserves and resources, our plans for the operation of the Bear Lodge project, estimated average annual production, life of mine, estimated net present value, internal rate of return, and payback period.

Forward-looking statements used in this discussion are subject to various risks and uncertainties, most of which are difficult to predict and generally beyond the control of the Company. Forward-looking statements in this document are not a prediction of future events or circumstances, and those future events or circumstances may not occur. If risks and uncertainties materialize, or if underlying assumptions prove incorrect, our actual results may vary materially from those expected, estimated or projected. Important facts that can cause the Company's actual results to differ materially from those anticipated in the forward-looking statements include risks associated with commodity prices; exploration results; governmental and environmental regulations, permitting, licensing and approval processes; conclusions of economic evaluations; mineral reserves and resource estimates; uncertainties related to construction timing and costs; increases in costs of supplies, equipment and other input costs; our ability to obtain adequate financing and to market our products; production rates; changes in project parameters as plans continue to be refined; the future market and prices for RE concentrates; possible variations in ore reserves, grades or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labor disputes, other risks of the mining industry and other factors described under the heading "Risk Factors" in our Annual Report on Form 10-K for the year ended June 30, 2011, filed with the U.S. Securities and Exchange Commission ("SEC") as updated by our subsequent filings with the SEC. Given these uncertainties, users of the information included herein, including investors and prospective investors, are cautioned not to place undue reliance on such forward-looking statements. The Company undertakes no obligation to update any forward-looking statements made in this press release to reflect future events or developments, except as required by U.S. and Canadian securities laws.