88

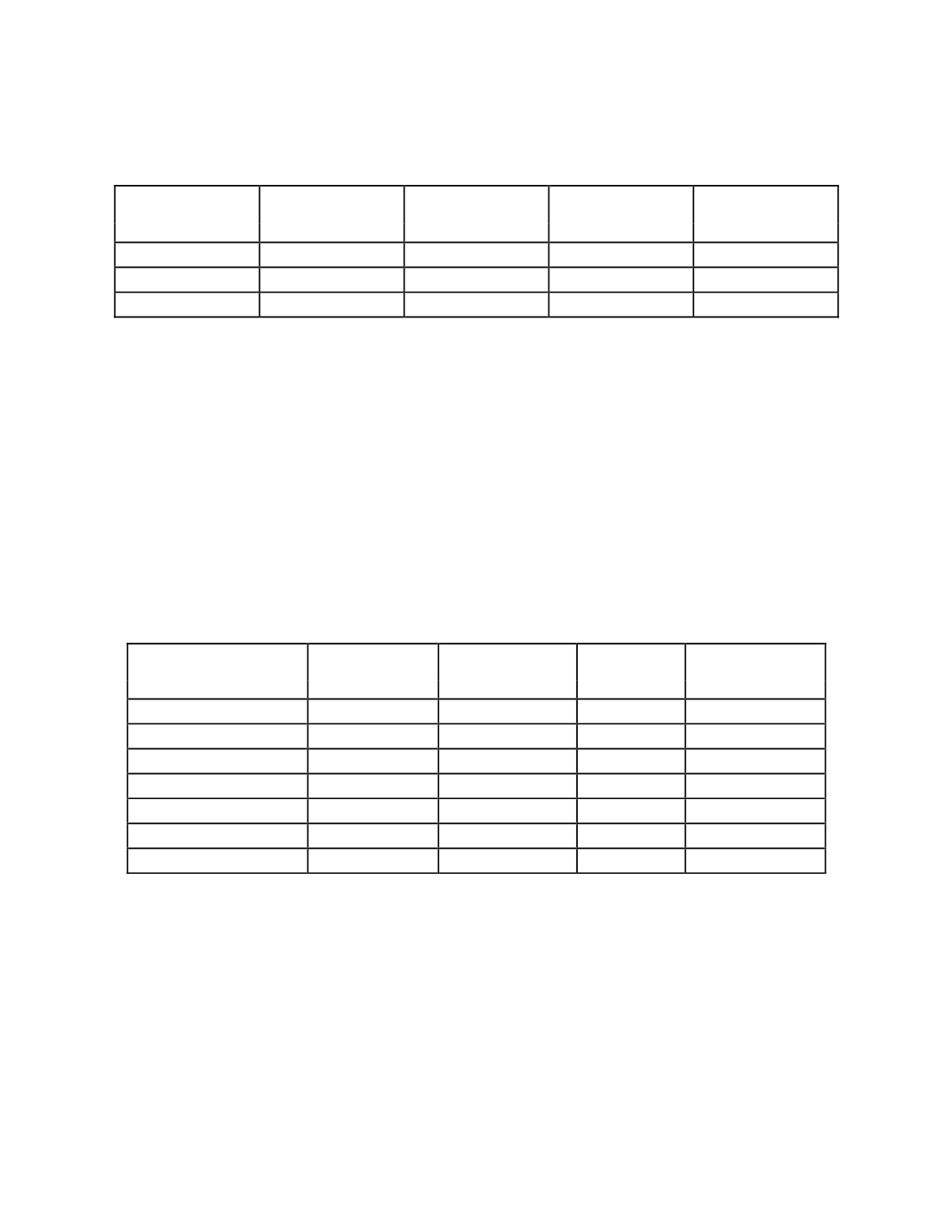

The table below sets out the estimated payments due to each of the NEOs employed by the Company as of

December 31, 2015 upon a qualifying termination or resignation within 12 months following a change of control

assuming termination or resignation on December 31, 2015.

Base Salary

(2x annual)

Bonus

All Other

Compensation

(1)

Total

Name

($)

($)

($)

($)

Randall J. Scott

504,000

-

-

504,000

Jaye T. Pickarts

477,600

-

-

477,600

Paul H. Zink

460,000

-

-

460,000

(1)

Salary and bonus payments, if applicable, are made in lump sum for each NEO upon a qualifying

termination.

Director Compensation

As of December 31, 2015, the outside directors, other than the Chairman, receive annual compensation of

$10,000, paid pro rata on a quarterly basis. The Chairman receives annual compensation of $30,000 per year. The

directors of the Company are encouraged to hold common shares in the Company, thereby aligning their interests

with those of the shareholders. In addition to the annual compensation and stock option awards, the Company pays

compensation to the chairs of each of the Audit Committee, NCG&C Committee and Finance Committee of $5,000

per year. Director compensation did not change in the year 2015; however, in December 2015, the Board

determined that director annual compensation would be suspended beginning in January 2016 until further notice to

support the Company’s cash conservation measures.

The following table sets forth information regarding the compensation received by each of the Company’s

outside directors during the year ended December 31, 2015:

Fees earned or

paid in cash

Option awards

(2)

All other

compensation

Total

Name

(1)

($)

($)

($)

($)

M. Norman Anderson

7,500

28,650

-

36,150

Norman W. Burmeister

7,500

28,650

-

36,150

Paul J. Schlauch

11,250

28,650

-

39,900

Patrick James

7,500

-

-

7,500

Lowell Shonk

20,716

28,650

-

49,366

Gerald W. Grandey

13,654

28,650

-

42,304

F. Steven Mooney

7,500

28,650

-

36,150

(1)

Mr. Scott’s director compensation is included in the NEO Summary Compensation Table.

(2)

The grant date fair value of option-based awards which are granted during the year ended

December 31, 2015 is determined by the Black-Scholes Option Pricing Model with certain

assumptions for the risk-free interest rate, dividend yields, volatility factors of the expected

market

price of the Company’s common shares and the expected life of the options. All options granted

expire five years after the grant date. All options have the same vesting schedule: 20 percent vest after

4, 8, 12, 15 and 18 months after the grant date until fully vested.