83

Perquisites and Other Personal Benefits

The primary benefits for the Company’s executives include participation in the Company’s broad-based

plans: the 401(k) plan (which has previously included matching Company contributions); health, dental and vision

coverage; life insurance; paid time off; and paid holidays. The Company terminated its health, dental and vision

plan, as well as its 401(k) plan in the first quarter of 2016 as one of its cost-conservation measures. The Company’s

NEOs are not generally entitled to significant perquisites or other personal benefits not offered generally to the

Company’s employees.

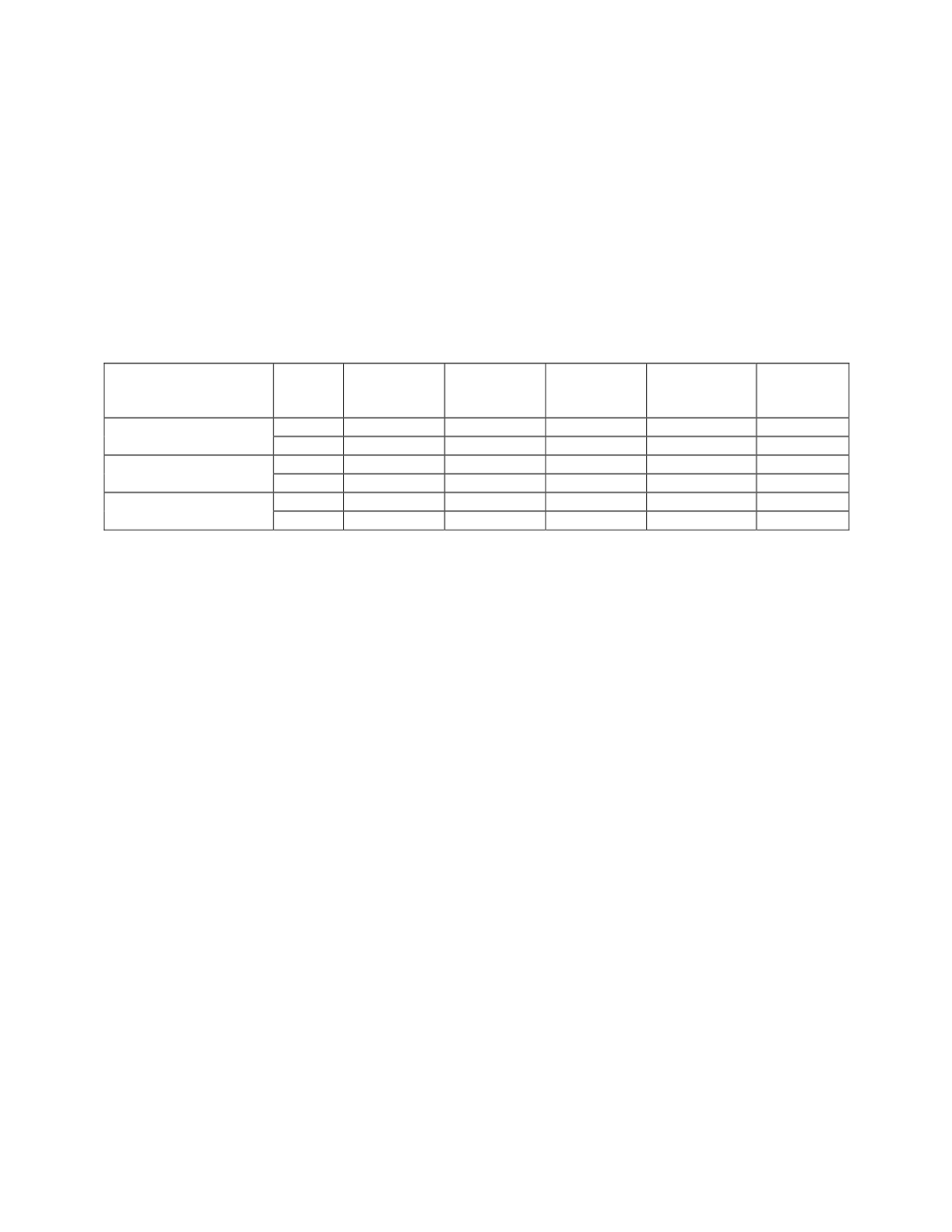

Summary Compensation Table

Set out below is a summary of compensation paid to the Company’s NEOs during the year ended December 31,

2015 and the year ended December 31, 2014:

Name and principal

position

Year

Salary ($)

Bonus ($)

Option

Awards

(1)

($)

All other

compensation

($)

(2)

Total

($)

2015

252,000

-

16,213

3,780

271,993

Randall J. Scott,

President and CEO

2014

252,000

-

-

10,080

262,080

2015

238,800

-

8,107

4,092

250,999

Jaye T. Pickarts,

COO

2014

238,800

-

-

9,404

248,204

2015

230,000

-

8,107

3,067

241,173

Paul H. Zink,

SVP and CFO

2014

230,000

-

30,734

6,133

266,867

(1)The grant date fair value of option-based awards is determined by the Black-Scholes Option Pricing Model

with certain assumptions for the risk-free interest rate, dividend yields, volatility factors of the expected

market price of the Company’s common shares and expected life of the options.

(2)All other compensation includes 401(k) matching by the Company.

Narrative Discussion of Compensation and Plan-Based Awards

Employment and Severance Compensation Agreements

The Company currently has employment agreements with certain executive officers, including

Messrs. Scott and Pickarts (collectively, the “Employment Agreements”). The material terms of these Employment

Agreements have included (a) employment for an indefinite term unless employment is terminated as provided in

the agreement; (b) severance arrangements, including upon a change in control; (c) a base salary; and

(d) participation in the stock option plans of the Company (as described below), the incentive bonus, and in such of

the Company’s benefit plans as are from time to time available to executive officers of the Company. See section

entitled “Base Salary” above for current base salary information.

In December 2012, the NCG&C Committee recommended, and the Board of Directors approved, a form of

Severance Compensation Agreement to be offered to the Company’s executives and certain key employees. These

agreements were offered as a replacement to prior employment agreements as described above. On April 24, 2013,

Mr. Scott entered into a Severance Compensation Agreement with the Company. Mr. Zink entered into his

Severance Compensation Agreement on June 16, 2014, following a six-month waiting period after his appointment

on December 12, 2013. Mr. Pickarts did not enter into a Severance Compensation Agreement, but is subject to his

employment agreement dated March 1, 2011.

The key terms of the Severance Compensation Agreement include (a) defined benefits for a qualified

termination, defined as one without cause or a resignation with good reason; (b) defined benefits for a qualified

termination within 12 months following a change of control; and (c) coverage under the Consolidated Omnibus

Budget Reconciliation Act of 1985 (“COBRA”) for 12 months following a qualifying termination. Mr. Pickarts’

employment agreement has some variation in the benefits, as further set forth in the section entitled “Potential

Payments upon Termination or Change of Control.” See that section below for a further description of the benefits

upon a qualifying termination.