67

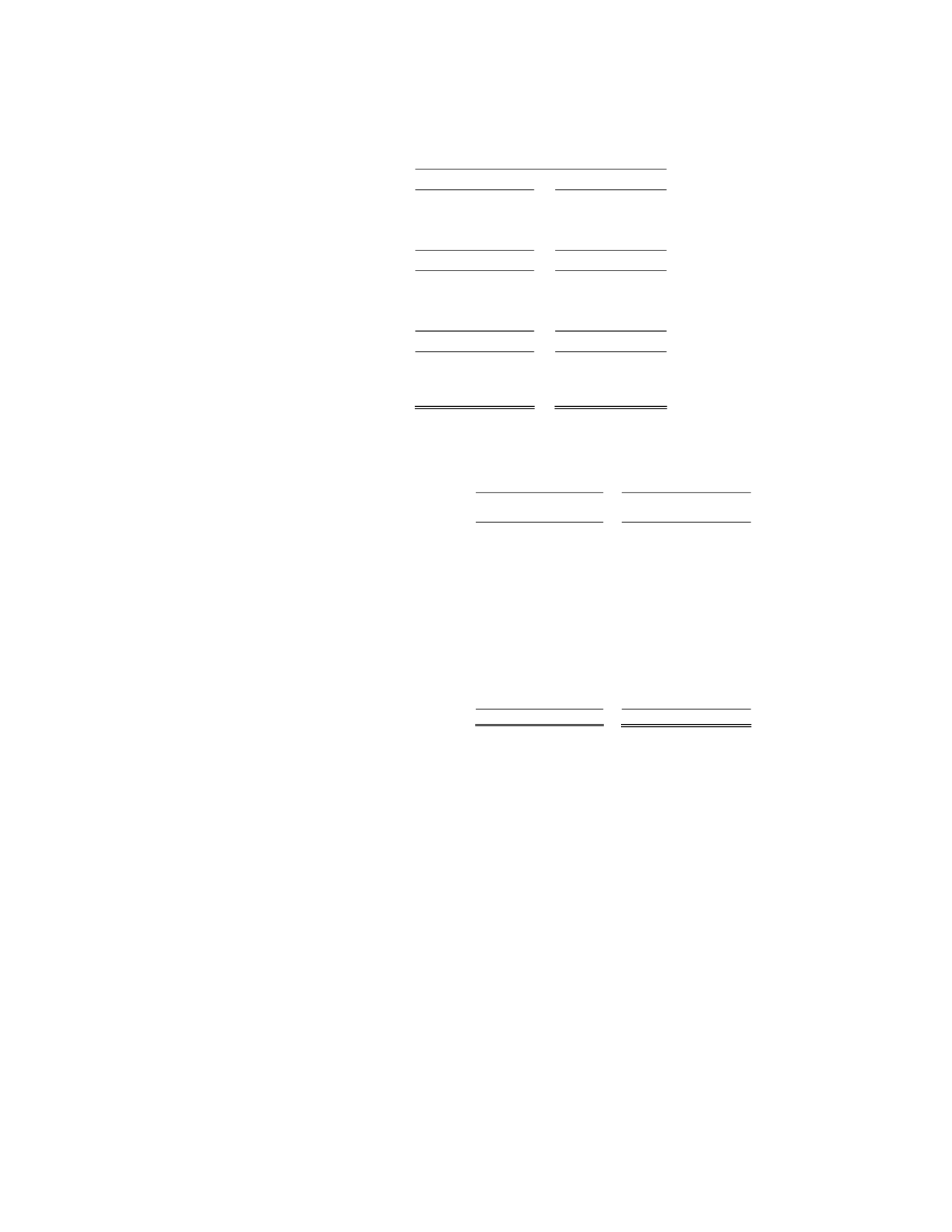

The provision for income taxes includes the following components:

As of December 31,

2015

2014

Current

Canada

$ - $ -

United States

-

-

-

-

Deferred

Canada

$ - $ -

United States

-

-

-

-

Income tax

expense

(recovery)

$ - $ -

A reconciliation of expected income tax on net income at statutory rates is as follows:

As of December 31,

As of December 31,

2015

2014

Net income (loss)

$ (9,678)

$ (14,029)

Statutory tax rate

26.00%

26.00%

Tax expense (recovery) at statutory rate

(2,516)

(3,648)

Foreign tax rates

(591)

(928)

Change in tax rates

166

27

Share issuance costs amortization

(103)

(220)

Stock-based compensation

569

155

Nondeductible expenses

17

5

Prior year true-up for loss carryovers

43

20

Prior year true-up for property basis

adjustments

-

(63)

Unrecognized benefit of non-capital losses

-

-

Other

-

-

Change in valuation allowance

2,415

4,652

Income tax expense (recovery)

$ -

$ -

We do not have any unrecognized income tax benefits. Should we incur interest and penalties relating to

tax uncertainties, such amounts would be classified as a component of the interest expense and operating expense,

respectively.

Rare Element and its wholly owned subsidiary, Rare Element Holdings Ltd., file income tax returns in the

Canadian federal jurisdiction and provincial jurisdictions, and its wholly owned subsidiary, Rare Element

Resources, Inc., files in the U.S. federal jurisdiction and various state jurisdictions. The years still open for audit are

generally the current year plus the previous three. However, because we have NOLs carrying forward, certain items

attributable to closed tax years are still subject to adjustment by applicable taxing authorities through an adjustment

to tax losses carried forward to open years.