65

The value of the warrants issued to the placement agent (non-employee) for its services in connection with

the September 27, 2013 offering was offset against the proceeds of the financing. The Company used a Black-

Scholes model with inputs including a market price of the Company’s common shares of $2.61, an exercise price of

$4.15, a three-year term, volatility of 80.9%, a risk-free rate of 0.62% and assumed no dividends. The value of the

warrants issued for services was estimated at $143.

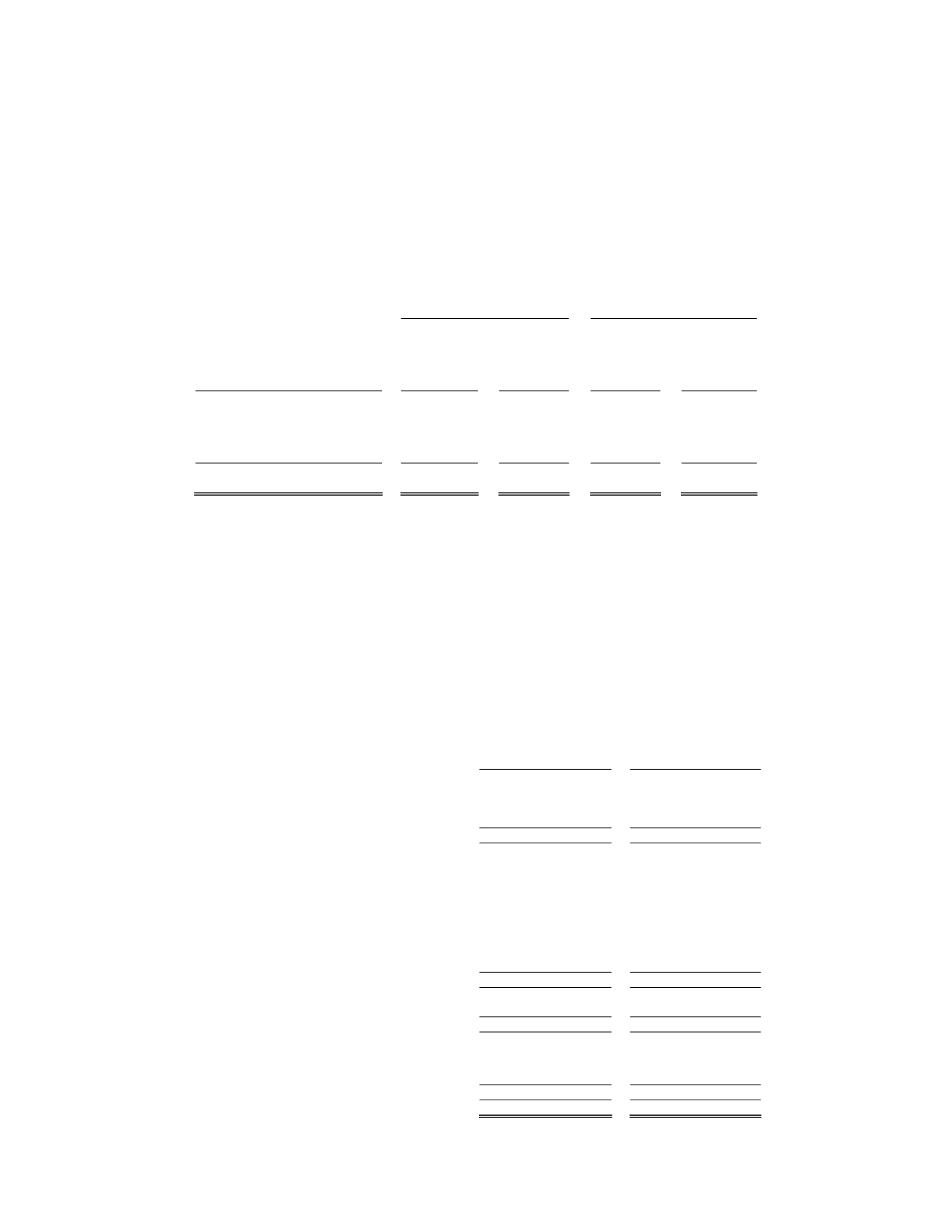

The following table summarizes activity for options and warrants for the years ended December 31, 2015

and 2014:

For the year ended

December 31,

2015

For the year ended

December 31,

2014

Number of

Options

and

Warrants

Weighted

-Average

Exercise

Price

(USD$)

Number

of

Options

and

Warrants

Weighted-

Average

Exercise

Price

(USD$)

Outstanding, beginning of period

1,472,557

$ 4.15

1,472,557

$ 4.15

Granted

2,876,924

0.85

-

-

Exercised

-

-

-

-

Expired

-

-

-

-

Outstanding, end of period

4,349,481

$ 1.97

1,472,557

$ 4.15

7. RELATED PARTY TRANSACTIONS

There were no related party transactions during the years ended December 31, 2015 and 2014.

8. INCOME TAX

We recognize future tax assets and liabilities for each tax jurisdiction based on the difference between the

financial reporting and tax bases of assets and liabilities using the enacted tax rates expected to be in effect when the

taxes are paid or recovered. A valuation allowance is provided against net future tax assets for which we do not

consider the realization of such assets to meet the required “more likely than not” standard.

Our future tax assets and liabilities at December 31, 2015 and 2014 include the following components:

As of December 31,

As of December 31,

2015

2014

Deferred tax assets:

Current:

Accrued vacation

$ 26

$ 39

Reclamation provision

52

57

78

96

Non-current:

Noncapital loss carryforwards, Canada

2,640

2,546

Capital loss carryforwards, Canada

7

7

Net operating loss carryforwards, U.S.

14,784

11,053

Mineral properties

13,017

14,244

Reclamation provision

70

69

Equipment

131

115

Share based compensation

3,362

4,020

Research and development

2,358

1,882

36,369

33,936

Deferred tax assets

36,447

34,032

Valuation allowance

(36,447)

(34,032)

Net

$ -

$ -

Deferred tax liabilities:

Non-Current:

Other

-

-

Deferred tax liabilities

-

-

Net deferred tax asset/(liability)

-

-