59

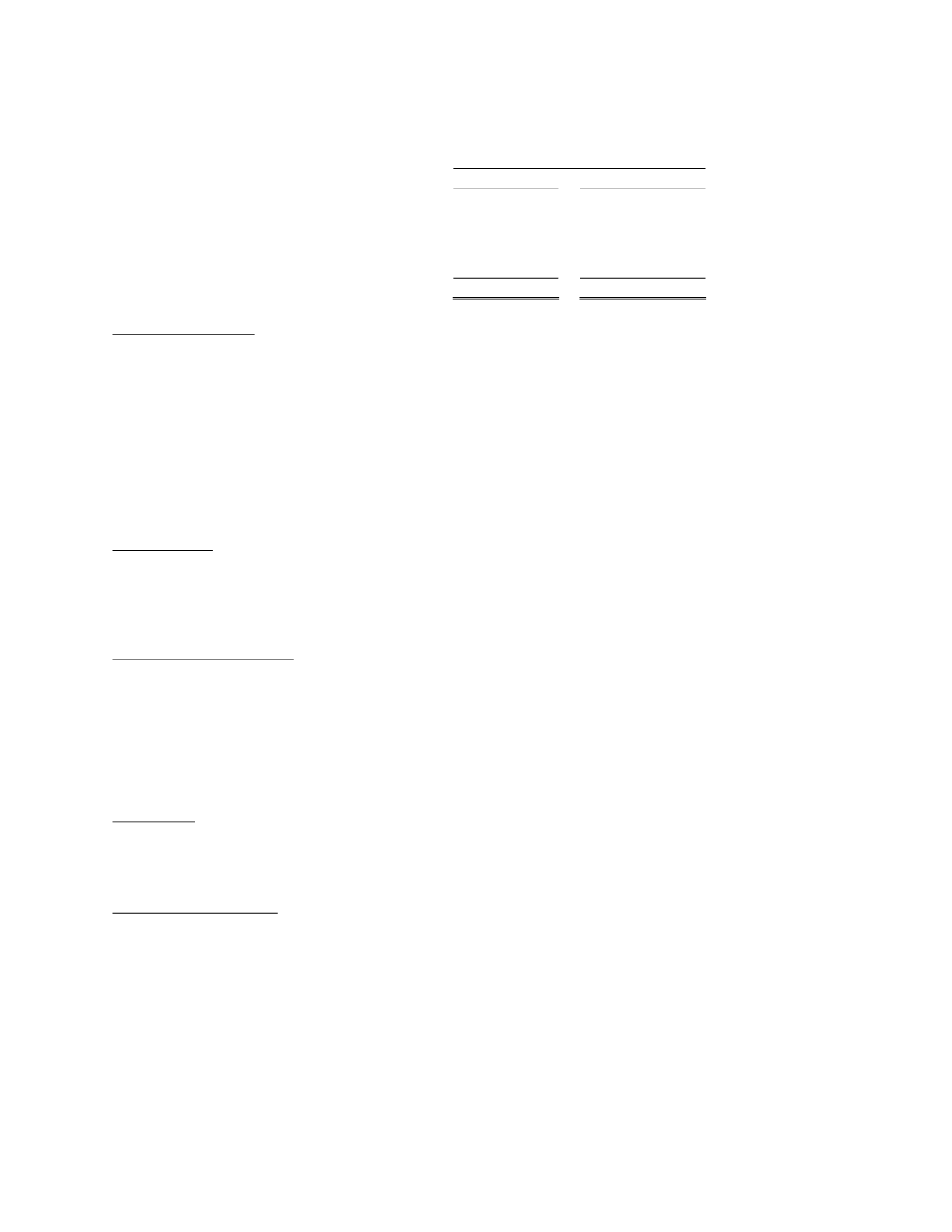

Changes in our asset retirement obligations are summarized in the following table:

Year ended December 31,

2015

2014

Balance, beginning of period

$ 366

$ 415

Additions

16

19

Releases

(25)

(66)

Revisions to cost estimates

-

(2)

Balance, end of period

$ 357

$ 366

Derivative instruments

From time to time, the Company may use derivative financial instruments to manage its foreign currency

risks. All derivative financial instruments are classified as current liabilities and are accounted for at trade date.

Embedded derivatives are separated from the host contract and accounted for separately if the economic

characteristics and risks of the host contract and the embedded derivative are not closely related. The Company re-

measures all derivative financial instruments as of the date of the balance sheet based on fair values derived from

option pricing models. Gains or losses arising from changes in fair value of derivatives are recognized in the

Consolidated Statements of Loss, except for derivatives that are highly effective and qualify for cash flow or net

investment hedge accounting. The Company does not have any derivatives that are highly effective and qualify for

cash flow or net investment hedging. There were no derivatives outstanding as of December 31, 2015.

Common shares

Common shares issued for non-monetary consideration are recorded at fair market value based upon the

trading price of our shares on the share issuance date. Common shares issued for monetary consideration are

recorded at the amount received, less issuance costs.

Foreign currency translation

Our functional currency is the U.S. dollar. All of our foreign subsidiaries are direct and integral

components of the Company and are dependent upon the economic environment of our functional currency.

Therefore, the functional currency of our foreign entities is considered to be the U.S. dollar in accordance with ASC

Topic 830, “Foreign Currency Matters,” and accordingly, translation gains and losses are reported in the loss for that

period. Assets and liabilities of these foreign operations are translated using period-end exchange rates and revenues

and expenses are translated using average exchange rates during each period.

Depreciation

Depreciation is based on the straight-line method. We depreciate computer equipment, furniture and

fixtures and geological equipment over a period of three years. We depreciate vehicles over a period of five years.

Stock-based compensation

The fair value of share-based compensation awards issued to employees and directors of the Company is

measured at the date of grant and amortized over the requisite service period, which is generally the vesting period.

The Company uses the Black-Scholes option valuation model to calculate the fair value of awards granted.

The fair value of share-based compensation awards issued to non-employees is determined on the

measurement date of such awards. The measurement date is typically the vesting date. Upon vesting, the fair value

of share-based compensation awards issued to non-employees is calculated using the Black-Scholes option valuation

model, and the amount is recorded as an expense with a corresponding increase in additional paid-in-capital.